Shareholder returns

Home » Shareholder returns

Our objective

Shareholder returns – $10,000 invested since inception

Dividends

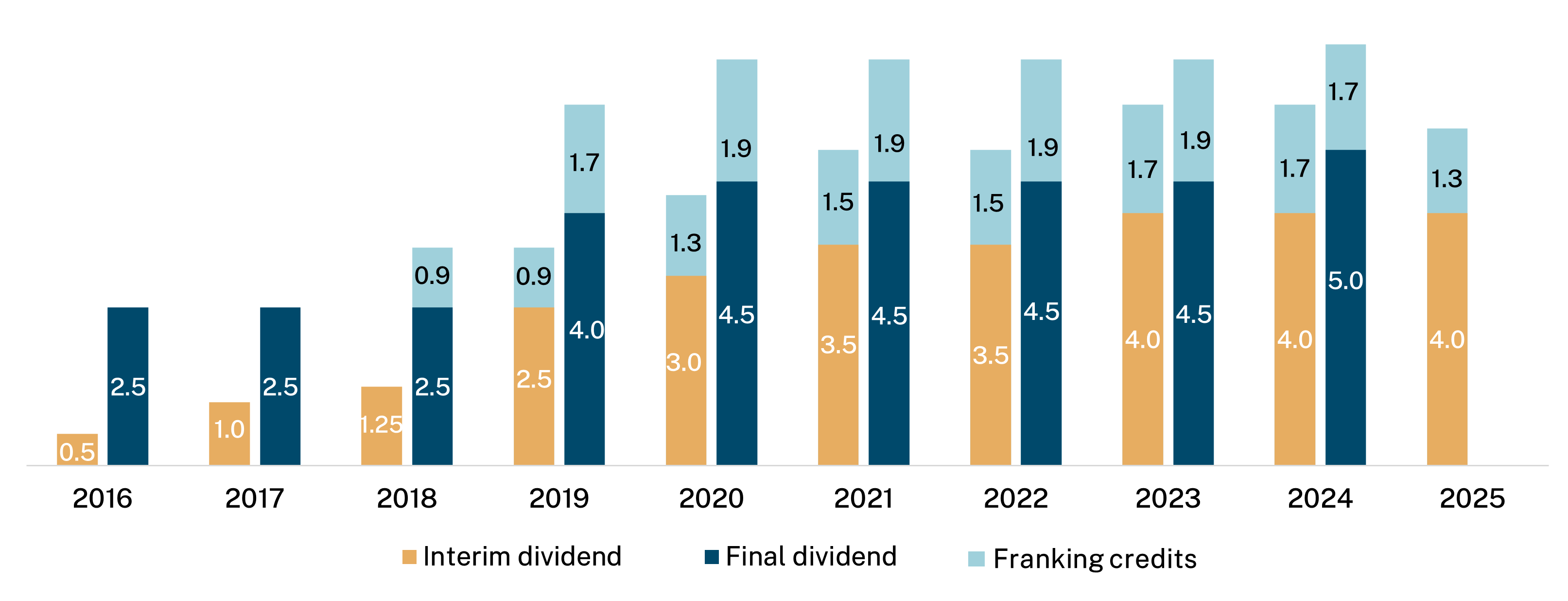

Argo Infrastructure’s Board is committed to delivering sustainable dividends with minimal volatility. Every year since our initial public offering (IPO) in 2015, dividends paid to shareholders have increased. Over recent years, dividends have been fully franked underscoring a key benefit of investing in offshore assets through our ASX-listed investment company (LIC) structure.

Annual dividends (cents per share)

Share price performance

Share price performance is measured by movements in Argo Infrastructure’s share price, assuming dividends paid are reinvested. Share price performance can be compared to the benchmark S&P/ASX 200 Accumulation Index, which measures the performance of the broader Australian share market, including dividends.

Portfolio performance

Total returns

Share price relative to NTA

| Argo Infrastructure shares can trade at a premium or a discount to the Company’s per share net tangible assets (NTA) value. This is mainly due to changes in the supply and demand for Argo Infrastructure shares as they trade between buyers and sellers on the ASX. On 30 June 2025, the share price traded at a discount -12.6% to the reported month-end NTA. The graph below shows the month-end share price premium or discount relative to NTA over time. |

|---|

Share price premium/discount to NTA

Narrowing the discount

We are focused on further reducing Argo Infrastructure’s current share price discount to NTA to better reflect the underlying value of the shares. We have implemented a range of initiatives aimed at achieving this objective including the selective use of share buybacks and buying on-market the shares to be issued to participants in the Dividend Reinvestment Plan and the Dividend Substitution Share Plan.