Understanding global listed infrastructure

Home » Understanding global listed infrastructure

Overview

Argo Infrastructure invests in a portfolio of global listed infrastructure companies. These companies derive revenue from infrastructure assets, including through owning, operating or developing infrastructure assets, located around the world.

What is infrastructure?

Infrastructure comprises the real or ‘hard’ assets critical to economic growth and the functioning of society. These assets fall into four broad categories:

Transportation

Toll roads, ports, freight and passenger railways and airports

Midstream energy

Pipelines and storage

Utilities

Gas, electricity, water and renewables

Communications

Wireless communication towers and satellites

For the companies that own and operate these assets, they generate consistent and predictable income with mandated pricing mechanisms, often linked to inflation.

Key characteristics

Stable and predictable cash flows

The essential service nature of infrastructure assets means demand is reasonably inelastic. This generates stable and predictable cash flows, even in economic downturns.High barriers to entry

Infrastructure assets are costly to build and difficult to replicate. This reduces competition and creates monopolistic market positions and pricing power.Long-life assets

As infrastructure assets are typically built to last 30 to 50 years plus, they provide long-term investment income.Inflation-linked pricing

Asset regulators generally take inflation into account when setting asset-pricing structures. This means that as inflation rises, asset operators are often permitted to increase user fees. These common characteristics translate into reliable, long-term income streams through various economic cycles.The offshore opportunity

After numerous government privatisations over many years, infrastructure is well understood by Australian investors. So why look overseas to invest in infrastructure?

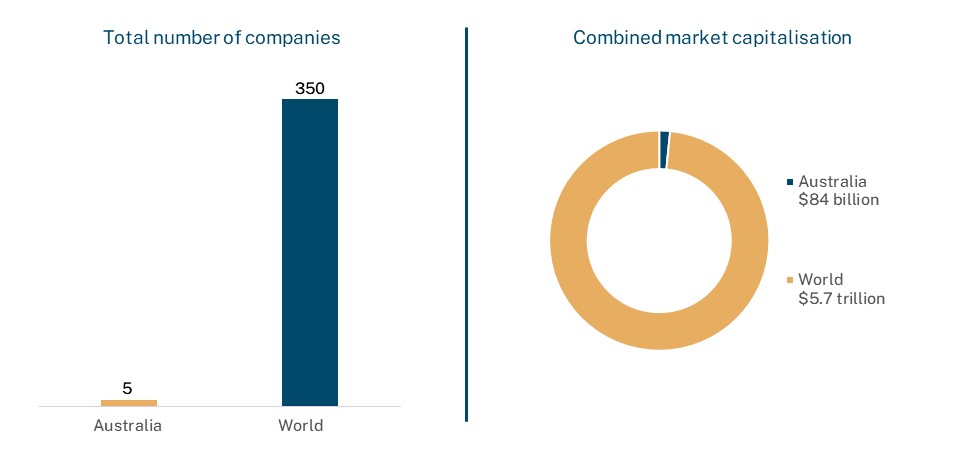

Australia’s listed infrastructure sector is mature and limited to just a handful of ASX-listed stocks, predominantly focused on toll roads, utilities and airports.

As the global economy moves towards net zero emissions, there are increasingly opportunities overseas to invest in renewable energy utilities, such as wind, solar and hydro power.

In contrast, globally there are around 350 listed “pure play” infrastructure companies, listed in 17 different countries and with assets located all over the world. The combined market capitalisation of these stocks is approximately $5.7 trillion, roughly triple the size of Australia’s entire share market.

Listed infrastructure: Australia versus World

New infrastructure opportunities

Australia’s infrastructure sector is mature and new opportunities to invest are limited. Offshore, the growth potential is much greater as the continuing privatisation trend is providing access to new infrastructure assets around the world. In the five years leading into the COVID pandemic, there were more than 50 infrastructure initial public offerings (IPOs), but none of those were in Australia.